Tax Insights

Stay at the forefront of tax developments with IBFD's comprehensive Tax News Service. Tailored for tax professionals, researchers, policymakers, and individuals keen on the latest tax insights in the Americas, our Knowledge Hub serves as the go-to platform covering key dynamics in the intricate world of tax law.

The IBFD Tax News Service stands out from other tax news sources because we prioritize quality over quantity. We deliver unparalleled insights and updates, without the useless chatter, focused on delivering content that truly impacts the tax field.

For professionals seeking the most recent tax policy news, and individuals looking to navigate the intricate world of tax law. It's that simple – our goal is to provide our readers with information that is not only relevant but also meaningful.

Excise Taxes & AI: How Technology Is Revolutionizing the Mysterious Tax You Never Knew You Paid

What is Transfer Pricing and Why Does it Matter?

Base Erosion and Profit Shifting - BEPS

A Guide to Mergers and Acquisitions

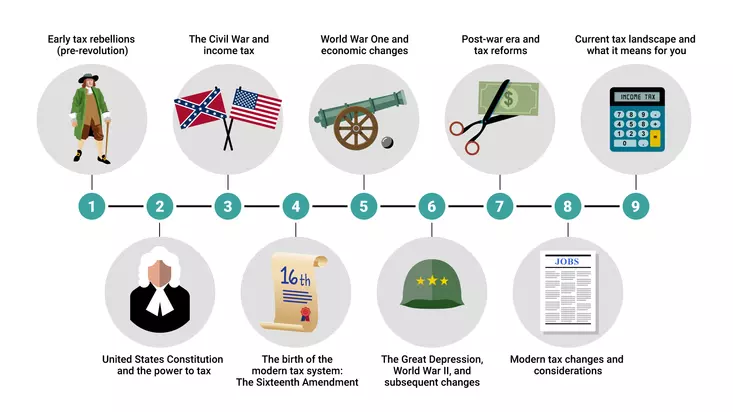

The History of Taxes in the United States: A Timeline

Navigating US Taxation with a Global Perspective

Decoding Digital Services Taxes: A Comprehensive Guide to the OECD's Proposal

The 15% Corporate AMT: What You Need to Know

What is a Tax Treaty Benefit and how can it help you?

Inflation Reduction Act's Clean Energy Tax Credits: What the IRA Hopes to Accomplish

New Reporting Requirement for Beneficial Ownership Information: What You Need to Know

The Economic Nexus Revolution: Navigating the Wayfair Era for Remote Sellers and Marketplace Facilitators

What You Need to Know About the Hydrogen Tax Credit

A Guide to Understanding Indirect and Direct Taxes

A Beginner's Guide to Cryptocurrency Tax

Optimizing Tax Efficiency: Ins and Outs of Foreign Tax Credits